Understanding Reject Code F8962-070

Reject code F8962-070 is a code that taxpayers may receive when they file their taxes. It indicates that there is an issue with the Form 8962, which is used to report the premium tax credit. The premium tax credit is a tax credit that helps individuals and families afford health insurance purchased through the Health Insurance Marketplace. The Form 8962 is used to reconcile the amount of the premium tax credit that was estimated in advance with the amount of the premium tax credit that the taxpayer is eligible for based on their actual income.

There are several reasons why a taxpayer may receive reject code F8962-070. One common reason is that the income reported on the tax return does not match the income reported to the Marketplace when the taxpayer enrolled in health insurance. This could be due to a change in income or a mistake in reporting. Another reason is that the taxpayer did not file a Form 8962 when they should have.

If you receive reject code F8962-070, it is important to take action to resolve the issue. This may involve filing an amended tax return or providing additional documentation to the IRS. If the issue is not resolved, you may not receive the premium tax credit that you are eligible for, or you may be required to repay some or all of the premium tax credit that you received in advance.

To fix reject code F8962-070, you should start by reviewing your tax return and Form 8962 to ensure that all information is accurate and matches the information that was reported to the Marketplace. If you find an error, you may need to file an amended tax return to correct it. You may also need to provide additional documentation to support your income or expenses.

If you are unable to resolve the issue on your own, you may want to seek assistance from a tax professional or from the IRS. The IRS offers a variety of resources to help taxpayers resolve issues such as reject code F8962-070, including phone support and in-person assistance at local IRS offices.

It is important to take reject code F8962-070 seriously and to take action to resolve the issue as soon as possible. Ignoring the issue or failing to respond to the IRS could result in additional penalties and fees, as well as loss of the premium tax credit that you are eligible for.

Common Reasons for Receiving the Reject Code

Receiving a reject code f8962-070 can be an overwhelming experience, especially since it means that something has gone wrong with your tax filing. Several reasons could cause the error message, including:

2. Tax Filing Errors

The tax filing process can be complex and confusing, and it is easy to make errors. Filing your taxes electronically makes the process more straightforward, but it also increases the risk of making mistakes since many people depend on the accuracy of tax preparation software.

One tax filing error that can lead to a reject code f8962-070 is incorrect or missing information on Form 1095-A, the Health Insurance Marketplace Statement. This form provides essential information about the health insurance coverage you purchased through the Health Insurance Marketplace during the previous year.

If the information on Form 1095-A is incorrect, such as the premium amount paid, family size, or coverage period, the Internal Revenue Service (IRS) will reject your tax return with the f8962-070 error code. Missing information, such as the dates of coverage or the name or social security number of the policyholder, could also lead to the same error message.

Another common tax filing error is incorrect data entry. Advancements in e-filing software have made completing your tax return easier than ever. However, an omission or typographical error like spelling your name incorrectly or entering the wrong social security number can cause the IRS to reject your tax return, leading to the f8962-070 error message.

You can avoid tax filing errors by carefully reviewing your filled tax forms for accuracy before submitting them electronically. Some tax preparation software can check your return for accuracy before submission. If the program detects an error, you can correct it before submitting the tax return to avoid a reject code.

If you have already submitted your tax return and received a reject code f8962-070 due to a tax filing error, you should correct the information on Form 1095-A or file an amended return, depending on the severity of the error. Amending your return can be a cumbersome process, so ensure you have all the necessary documents before you start the process. Remember that you have three years from the due date of your original tax return to file an amended return.

In summary, tax filing errors can trigger a reject code f8962-070, leading to the rejection of your tax return. Ensure you provide accurate information on Form 1095-A and carefully review your tax return for errors before submitting it electronically. If you experience a reject code f8962-070, check the IRS instructions for the specific error code and instructions to correct it. Alternatively, you can seek help from a tax professional to help you resolve the issue quickly.

Steps to Fix Reject Code F8962-070

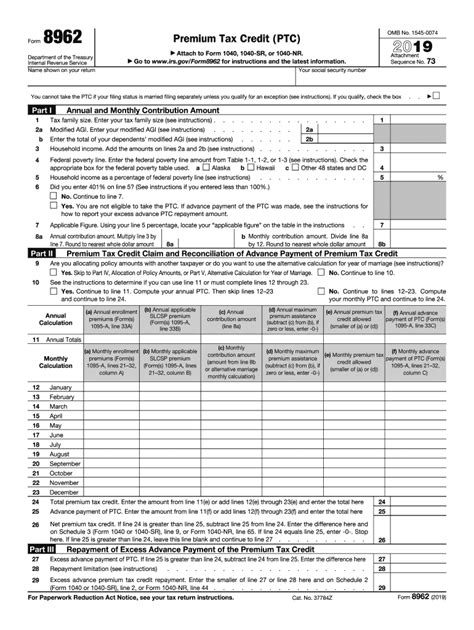

Reject code f8962-070 indicates that there is an error in the IRS form 8962, which is used to claim the premium tax credit. This credit assists individuals or families with low to moderate incomes to afford health insurance coverage bought through the Marketplace.

This article provides a step-by-step guide on how to fix reject code f8962-070 and submit your return with the correct information.

Contents

Step 1: Review Your IRS Form 8962

Review your IRS form 8962 to determine where the error occurred. Among the most common mistakes that result in reject code f8962-070 are incorrect calculations or wrong information on household income, filing status, and tax return. Check the form thoroughly to ensure that everything is accurate.

Step 2: Make Necessary Corrections

If you find errors on the form 8962, you will need to correct them. Mark the changes using a red pen and submit the corrected form. You can also make the corrections online by logging into your tax account or by using one of the many online tax preparation software.

Step 3: Submit the Correct Form 8962

![]()

After correcting any errors and ensuring that IRS form 8962 is accurate, submit the corrected form to the Internal Revenue Service. This should fix your reject code f8962-070 and enable you to file your tax return without any further delays.

It’s important that you submit the correct form immediately to avoid additional penalties or fees. You may also want to double-check all your tax-return forms before submitting them to the IRS to avoid any related errors.

Conclusion

Reject code f8962-070 is usually due to an error with the IRS form 8962. By following the steps described above, you should be able to correct any inaccuracies of the form and resubmit it to the IRS. Remember always to double-check your forms before submission, to avoid further delays and penalties. If you have any questions or require more help with tax filing, contact the appropriate experts.

Tips for Avoiding Future Rejections

When filing taxes, no one wants to receive a reject code that delays their refunds. Some reject codes, like f8962-070, are easy to fix, while others may take some time to investigate and resolve. To prevent future rejections and unnecessary delays, here are some tips to consider:

1. Make Sure All Information is Accurate and Current

When completing a tax return, it is important to verify that all the information provided is accurate, including your name, social security number, and address. Small errors like a typo in your name could trigger reject codes. Additionally, ensure that your mailing address is up-to-date, as the IRS will send notices and refunds to that address. If you have moved or changed your address, be sure to update it with the IRS.

2. Be Thorough and Organized

Ensure that you have included all required forms, schedules, and supporting documents when filing your taxes. It is also important to arrange them in the correct order, so they are easy to locate and read. By being thorough and organized, not only are you increasing your chances of avoiding errors, but you are also making it easier to navigate in case of a future audit.

3. Confirm Any Changes Before Submitting

Review and confirm any changes made to your tax return before submitting it. This includes double-checking calculations, as simple mistakes could result in costly errors. Before finalizing and submitting your return, take the time to verify that everything is accurate and that you are not forgetting anything.

4. Use e-File Instead of Paper Filing

One of the easiest ways to avoid rejected tax returns is by filing electronically instead of paper filing. The chances of errors or omissions are significantly reduced as the IRS’ e-file system guides you through the filing process and prompts you to supply necessary information. Additionally, e-filed returns are automatically checked for mistakes and inconsistencies that may result in a reject code.

E-filing your tax return with a reputable tax software program also provides an extra level of security as your sensitive information is encrypted and transmitted directly to the IRS. If you are entitled to a refund, e-filing is the quickest way to receive it.

5. Seek Professional Assistance

If you are unsure of how to prepare your tax return or have a complicated tax situation, it is always best to seek professional assistance. Tax professionals have the expertise and training to ensure that your tax return is accurate and compliant with IRS regulations. They also can help you navigate any complex tax codes and ensure you haven’t missed any critical forms or documents. By seeking the aid of a tax professional, you could potentially save yourself time and money in the long run by avoiding penalty fees and unnecessary audits.

By following these tips, you can avoid future tax return rejections and delays in receiving your refund. Remember that the best way to avoid a rejected return is by being thorough, organized, and accurate. If you do encounter a reject code, don’t panic. Instead, take the time to investigate and make any necessary adjustments, and then resubmit your return as soon as possible.

What to Do If You’re Unable to Fix the Reject Code

If you have tried every possible way to fix your reject code f8962-070 and you’re still stuck, then you should take these steps to resolve the problem.

1. Reach Out to IRS Support: You can contact the IRS support team to find out what may be the issue with your tax document. Be sure to have all relevant information, including your Social Security number, federal income tax return, and any other relevant documents, ready when contacting the support team.

2. Speak to a Tax Professional: If you’re unable to resolve the issue on your own, seek advice from a tax professional. You can hire a tax preparer or an enrolled agent to file your documents for you, which may help you in getting your return approved.

3. File Your Taxes Via Mail: If all else fails, try to file your taxes via mail. You can print out and mail the corrected portions of your form, along with any relevant documentation, to the IRS. Include a note explaining your situation and requesting that your rejected form be accepted. It may take longer, but this option may help you resolve the issue altogether.

4. File An Extension: If the deadline is approaching and you’re still unable to fix the problem, you can file a tax extension. This will give you an extra six months to file your taxes. However, bear in mind that you’ll still be required to pay any owed taxes by the initial deadline, even if you’re granted an extension.

5. Be Patient: Tax return processing can take time. If you’re unable to fix your reject code, keep checking your online account or mailbox to see whether your return has been accepted or if more information is required. Alternatively, you can contact the IRS support team for an update.

Dealing with reject codes can prove frustrating and time-consuming. However, with the right approach, proper documentation, and a little patience, you can resolve the issue and get your tax return accepted. Be sure to take as much time as you require to understand the rules, fill out your form correctly, and provide all necessary documents to the IRS. With persistence, you’ll be able to complete the process and get your refund check in the bank.